Last Call panel responds to Pres. Biden’s speech as he vows to stay in 2024 race

"I was always apprehensive about a second Biden term" - Don Peebles

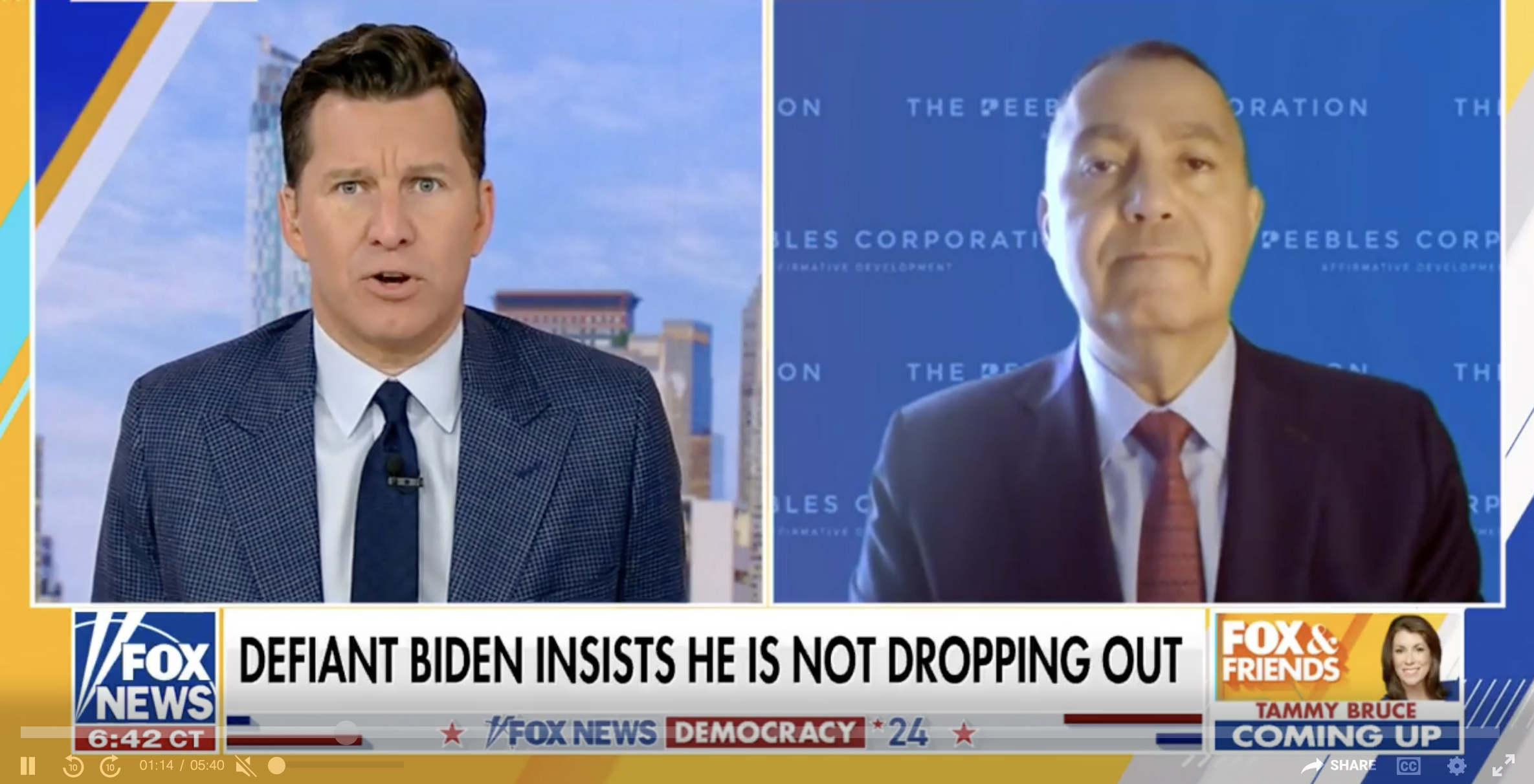

Former Obama fundraiser Don Peebles joins ‘Fox & Friends Weekend’ to discuss President Biden insisting he will not drop out of the 2024 election.

View the full interview on Fox News.

Former Obama Fundraiser

Former Obama Fundraiser Don Peebles to Neil on Biden's debate performance and calls for him to step aside: "[Biden's] time has come and gone".

Listen to the full interview here.

The Peebles Corporation Chairman and CEO Don Peebles discusses the challenges for Democrats in New York and how much the migrant crisis costs the state on 'Making Money.'

Click here to see the full clip on FoxBusiness.

Don Peebles, Peebles Corporation CEO, joins ‘Power Lunch’ to discuss the Fed’s hawkish message to leave rates unchanged.

Click here to see the full clip on CNBC.

Don Peebles, Peebles Corporation CEO and chairman; William Lee, Milken Institute chief economist; Julia Coronado, MarcroPolicy Perspectives founder; David Zervos, Jefferies chief market strategist; Claudia Sahm, New Century Advisors chief economist; and Paul McCulley, Pacific Investment Management Co. former chief economist, join ’Power Lunch to participate in a mock Fed board.

Click here to view the full interview on CNBC.

Don Peebles, former Obama adviser and Peebles Corporation CEO and founder, joins 'Cavuto: Coast to Coast' to discuss Biden's re-election campaign and the issues posed by Hunter Biden's trial, inflation, and former President Trump's conviction.

Watch the full interview on FoxBusiness.com

Former Obama fundraiser Don Peebles discusses former President Trump holding an event in the Bronx on 'Your World.'

View the interview from FoxNews.com.

Don Peebles, chairman and CEO of the Peebles Corporation, joins CNBC’s ‘The Exchange’ to discuss possible housing slowdowns, where to find opportunity in real estate, and more.

View the interview from CNBC.com.

As optimism about interest rate cuts this year fades, many CRE professionals find themselves slogging through, working with what they have amid the uncertainty over what’s to come.

There’s stress everywhere, Cityview Chief Operating Officer and Chief Financial Officer Damian Gancman said at Bisnow’s Finance and Deal-Making Conference at the Westin Bonaventure Hotel and Suites in Los Angeles Thursday.

THE PEEBLES CORPORATION®

NEW YORK

BOSTON

WASHINGTON, DC

CHARLOTTE

ATLANTA

MIAMI BEACH

SAN FRANCISCO