Former Obama fundraiser makes big prediction about 2024 race and Donald Trump: ‘I see him winning’.

Making it in commercial real estate means dealing with adversity, and industry moguls who want to pass their companies down to the next generation are making sure to prepare their kids to take on the family business.

For many, that means starting to bring their offspring into their world at a young age.

Read the original article at Bisnow.com

Former Obama fundraiser speaks out against allowing foreign countries to 'pillage' the marketplace.

See the full interview on Fox News

Don Peebles joins CNBC ‘Power Lunch’ to address the impact of the rate cut on real estate.

Click here to view the full interview.

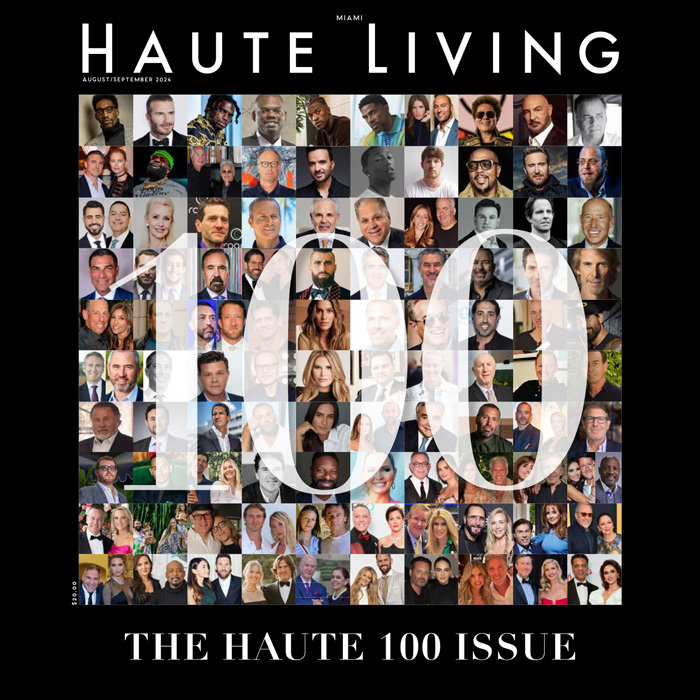

The annual Haute Living's Haute 100 list for 2024 is officially here, celebrating the most influential names in Miami, including philanthropists, entrepreneurs, power couples, developers, creatives, athletes, hospitality power players, and more.

See the full list on HauteLiving.com.

Panelists Kevin Hassett and Don Peebles join ‘Maria Bartiromo’s Wall Street’ with their take on former President Trump and Vice President Kamala Harris’ economic agendas.

Click here to see the full interview.

The Peebles Corporation founder, Chairman and CEO Don Peebles assesses homeownership in the U.S., housing in NYC and rental costs.

See the full interview on Fox News.

Former Obama fundraiser Don Peebles joins ‘Fox & Friends’ to discuss Vice President Kamala Harris vowing to create an ‘opportunity economy’ despite the Biden administration's failing inflation record.

Click here to watch the full interview on Fox & Friends.

THE PEEBLES CORPORATION®

NEW YORK

BOSTON

WASHINGTON, DC

CHARLOTTE

ATLANTA

MIAMI BEACH

SAN FRANCISCO